Decision-Making Lessons From the Craziest Trade In NBA History

What the Luka Dončić trade says about us

I am a big sports fan, but I don’t write a lot about sports because:

There are a lot of great sports writers, and I don’t write things when I can’t provide unique insights.

I know a lot of you aren’t sports fans, so I don’t write things that aren’t relevant to you.

So when, last week, I wrote about finding your unfair advantage using college football stories, I thought that would be it for me writing about sports stories for a long time.

But that changed three days ago.

The craziest (and possibly the worst) trade in NBA history just happened, and it perfectly illustrates two of my most important principles in life and achievement—1. use principles, not predictions, and 2. don’t try to be the smartest person in the room.

Some background:

The National Basketball Association is a weird sports league where the 30 teams can trade players with each other when team owners and managers agree to these trades. Based on their contract structures, when a player is traded, there is nothing he can do but play for the new team.

The NBA is also a star-driven league, meaning that having one great basketball player can hugely impact a team’s performance for a long time. This is different from football or soccer, where, other than star quarterbacks, one player doesn’t determine the success of the team.

That’s why NBA trades for top-5 players are extremely rare. When you have a generational talent like that, you hold onto them for a long time and contend for championships year after year.

Luka Dončić is that kind of player.

Dončić, a 25-year-old Slovenian, is widely seen as an offensive genius. He can score the basketball with an ease that very few other players can. In the six years he has been in the NBA, he has been widely regarded as a top-5 player. When he retires, he will be regarded as one of the best players ever.

Just last year, he single-handedly took the Dallas Mavericks to the NBA Finals. However, during the Finals, Dončić’s biggest weakness—lack of defense—was exposed and exploited by the opposing Boston Celtics, who beat them in five games.

That said, taking a team to the Finals as a 25-year-old is an extremely impressive feat. NBA players usually peak in athletic performance between ages 28–31, so Dončić is still three years away from his prime. The future was bright. Every other team would love to have a player like Dončić, given the combination of his age, ability, and achievements.

Except for one person: the Mavericks’ General Manager, Nico Harrison, who isn’t nearly as impressed with Dončić as the rest of the world.

Harrison took over the management role four years ago, and there are rumors that he didn’t like Dončić’s work ethic and conditioning.

This year, the Dallas Mavericks entered the season with the third-highest odds to win the NBA championship. But the season didn’t start as smoothly as the team would have liked. In fact, Dončić was injured during a game and had been sidelined for the past few weeks. But injuries to players happen all the time. Dončić was scheduled to return soon.

The Trade

Then the unthinkable. Last Saturday night, Nico Harrison traded Dončić to the Lakers for Anthony Davis, who is a top-15 player in his own right but an aging 31-year-old injury-prone veteran who is about to exit his athletic prime.

When ESPN journalist Shams Charania first broke the news on X, it was so unbelievable that people thought his account had been hacked. After they found out it was real, the entire sports media went into a frenzy, with non-stop coverage of the trade for the next few days.

The crazy and unexpected nature of this trade was like the sports equivalent of 9/11. And to Dallas Mavericks fans and their fandom, it might have felt that way too.

Immediately after the trade, every person familiar with the NBA—other than Lakers fans, of course—called it the worst trade in history.

Including me.

In the press conference following the trade, Nico Harrison explained that his rationale was that he believes Anthony Davis can better help the Mavericks win a championship this year since he is a better defensive player.

When asked about how this would impact the Dallas Mavericks’ future for the next 10 years, since Dončić is a rising star who is six years younger than Davis, he simply said, “The future to me is three to four years from now. The future, 10 years from now, they’ll probably bury me and J-Kidd (the head coach) by then. Or we’ll bury ourselves.”

This reasoning sounds suspiciously similar to a famous quote: “In the long run, we are all dead.”

Harrison’s press conference, rationale and attempted humor didn’t make Dallas fans feel any better. They were initially shocked and quickly descended into anger and despair. Their sports hero—someone they had rooted for and even worshiped for years, a top-five player, someone who had just taken their team to the cusp of a championship last year—was no longer on their team.

You could see the impromptu protest in front of the Dallas Mavericks’ arena, with coffins and chants for Nico Harrison to be fired.

I share their sentiment and feel bad for them.

The (Bad) Business of Predictions

OK, now you’ve read enough about the story. It’s a crazy sports story, but what does that have anything to do with the Art of Achieving Ambitious Things?

Well, it illustrates two of my enduring and related principles:

Make decisions based on principles, not predictions.

Don’t ever try to be the smartest person in the room.

By going against basically everyone’s opinion (informed or not), Nico Harrison acted like he was the smartest person in the room. He made a “tough decision.”

Will he be right? Maybe. Luka Dončić could very well get hurt again or get hit by a bus (heaven forbid). And Anthony Davis might very well go supernova this year, and they could win the championship. Hey, a nuclear war might happen tomorrow, and we could all be dead. Who knows?

After all, the world is unpredictable.

But let me repeat it: the world is unpredictable.

That’s why you don’t try to predict it. You build principles and live by them.

Whether Nico Harrison turns out to be right doesn’t matter. I don’t approve of his mindset and decision-making process.

He had a predictor’s mindset when making this decision. He is predicting that Anthony Davis is a better bet for his team than Luka Dončić to win a championship this year, even though Dončić just took the Mavericks to the Finals last year. He is predicting that Dončić will be injury-prone going forward, even though Davis has been far more injury-prone throughout his career.

And in doing so, he violated an enduring principle in NBA team-building: you simply don’t trade a 25-year-old rising player who has the chance to become one of the top 10 players in NBA history for a 31-year-old who is on the downside of his career.

Going with prediction vs. principles is what gets a lot of people into trouble. Many very smart people’s downfalls were based on their “expert predictions” about the future that turned out to be completely wrong.

Numerous studies have shown that “subject matter experts” are no better at predicting the future than average, uninformed people. This has been proven in the stock market, politics and social science.

Does this mean that a leader like Nico Harrison shouldn’t make decisions based on what he thinks is right for his team? Of course not. However, he shouldn’t bet the entire future of his team—trading away a generational player who only comes around once in a decade—on a simple prediction. It’s way too risky.

If he’s right, he slightly improves his team’s competitiveness for the next 1–2 years.

If he’s wrong, he just lost the cornerstone of his franchise for the next 10 years.

It’s akin to trading in your 2022 BMW for a 2016 Cadillac because you have a hunch that the Cadillac can eventually last longer.

My Own Story

I learned the lesson of trusting principles over predictions the hard way.

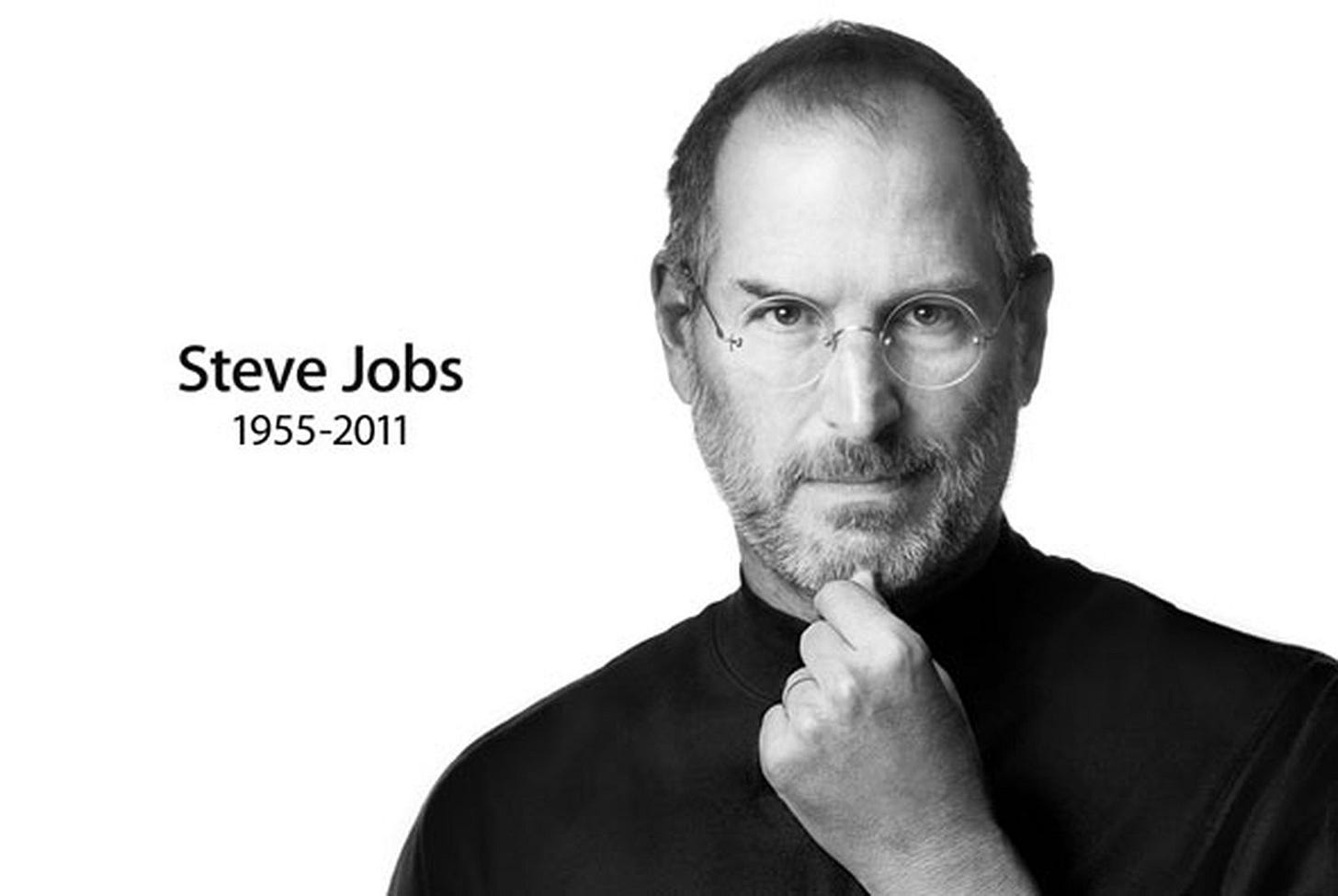

In October 2011, when Tracy and I were on a trip to Europe, another shocking news ticker came across my iPhone—”Steve Jobs, Apple founder, dies.”

There had been rumors about Steve Jobs’ health issues for a long time, even though he had once famously and humorously said, “The reports of my death are greatly exaggerated.”

Well, at that moment, it was no longer an exaggerated rumor, but an unfortunate reality.

I had long been an admirer of Steve Jobs, probably in the same way Dallas Mavericks fans admired Luka Dončić. After the initial shock and mourning, one thought quickly came to my mind: What about my Apple stock?

As I mentioned, I am a long-term stock investor. I developed an investment philosophy called Love Investing—I research and invest in stocks I love, both as a hobby and as a tool to build wealth.

One of my best holdings was Apple. In 2008, I bought Apple stock at $6.08/share. I did so not because of Steve Jobs but because I loved Apple products. I was an early adopter of the iPod. In 2008, I left my PC for a MacBook and never went back. That same year, I bought my first iPhone, and my entire tech world and habits changed forever.

This was my principle—buying and holding stocks of companies whose products I love and can’t live without.

But the shocking news of Steve Jobs’ death took me out of that principle and into a predictor’s mindset, just like Nico Harrison did with Luka Dončić.

I started thinking:

“Hmmm… Steve Jobs was one of the best innovators in business history. He was the one who founded Apple and took it from the cusp of bankruptcy back to glory. He was the one who came up with the Mac, iPod, iPhone, and everything I love about the company. If he’s gone, Apple will lose its innovation engine. This Tim Cook guy… I don’t know. He looks like a back-office accountant, definitely not Steve Jobs the innovator. Apple is going downhill from here.”

This rationale was sound, at least to me. In fact, it was sound to a lot of investors—millions of Apple stockholders sold their shares in fear of Apple’s impending downfall.

Including me.

I sold my Apple stock at $13.61/share, earning a 124% profit.

Big mistake!

As it turned out, Tim Cook was also a genius—just a different kind of genius. He wasn’t as innovative when it came to product design and development as Steve Jobs, but he was even more of an innovator in operations and manufacturing.

Since the death of Steve Jobs, Tim Cook built Apple into the most valuable company in human history, with a market capitalization of $3.5 trillion.

Apple stock went from $11.40/share the day Steve Jobs died to $232.80/share today.

Who would have predicted that? Well, some people did, and some didn’t. But that’s the rub: the world is unpredictable.

Principles Over Prediction

My mistake taught me two important lessons:

No one can predict the future, no matter how smart or educated you think you are. Don’t try to be the smartest person in the room.

Use life experience to build enduring principles. When you find your principles, hold onto them. Always use principles, not predictions, to guide your decisions.

Ever since my Apple stock failure, I have (almost) always adhered to my investment principles:

Invest in companies whose products you love and can’t live without.

Don’t try to time the market.

Never make decisions based on news headlines.

And the application of “principles over predictions” goes beyond stock investing—I always try to discover and adhere to enduring principles in life.

Some of my life principles include:

Love the work you do, do the work you love.

Think like an artist in everything you do, and you’ll be at your best.

Be a good person.

Be system smart—use systems to maximize your strengths and complement your weaknesses.

Business author and thinker Jim Collins once said that it’s better to make a few big decisions that can be applied to many situations rather than making many small decisions.

Having principles in life is like making the few big decisions. It takes away the small decision-making process from your emotions, predictions, and circumstances.

Luckily for me, I quickly learned my lesson and amended my mistake. After selling for $13.61/share, I bought back Apple stock at $18.20/share in December 2012. At $232.80/share today, it was a 1,179% increase. I will never sell again unless I no longer like Apple products.

But for Nico Harrison and the Dallas Mavericks, I am not sure they can recover that quickly from this decision and prediction. But for the Mavericks’ fans’ sake, I hope they eventually do.

For You

Now, do you have any principles you would live by rather than individual predictions? Have you ever been tripped up by predictions you thought were absolutely right at the time? Leave me a comment.

I really appreciate your wisdom here and the sports analogy really helps it land for me. I also love your love approach to investing. I am wanting to revisit my decision making principles (maybe clarify or even intentionally define would be a better way of saying it) in light of what you’ve written. Love is one of my core values - how can I ground my decision making in it?

This also helps me cope with our VUCA world and the discomfort and pain of recent events. Things feel particularly unpredictable now - so the clearer I am on my decision making principles principles the more I will feel sovereign and less at the effect of events beyond my control.

Thank you.

Hello! You wrote that the world is unpredictable and that “no one can predict the future, no matter how smart or educated you think you are. Don’t try to be the smartest person in the room.” I’m thinking that you are not a fan, supporter, or participating in sports betting. Betting is making predictions and since the world is unpredictable, it’s a gamble, a gamble that will most likely not reward you.